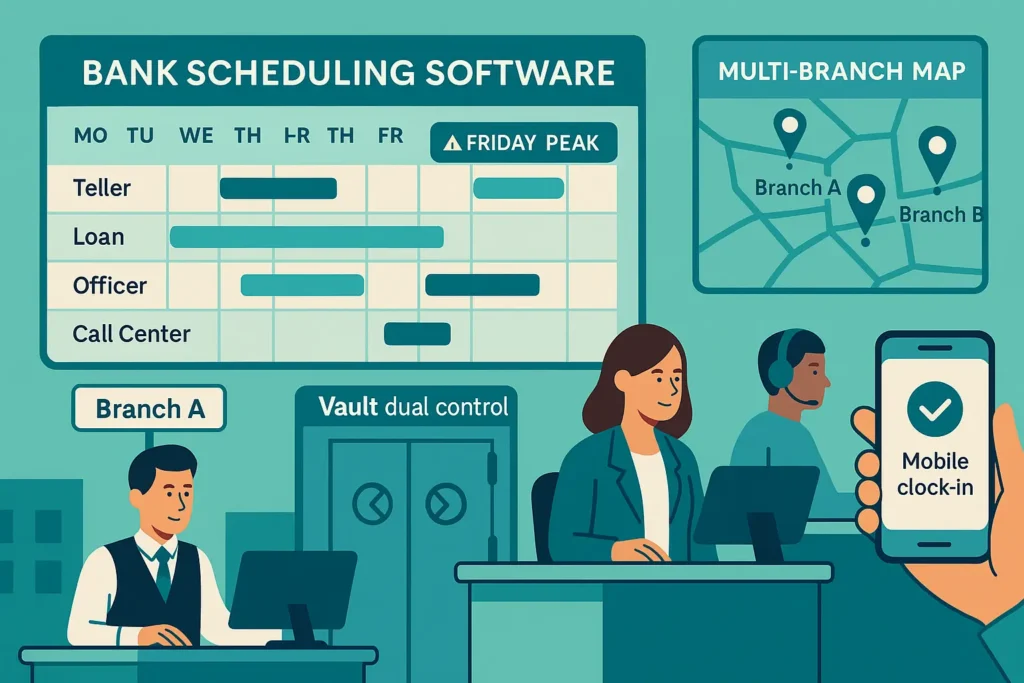

Banks rely on timing. Branch doors open at nine. Payroll Fridays see a spike in foot traffic. Call centres stretch on storm days. Vault access requires two people at once. Back-office teams close off the previous day before noon. When plans are kept in emails and spreadsheets, queues grow and managers have to guess. A shared system solves that. It places people, skills, breaks, and locations on a single live roster—then logs hours cleanly for payroll and audit. Choosing bank employee scheduling software is how branch networks maintain steady service while protecting staff time.

A good tool helps beyond banking. Retail, logistics, and service teams face the same crush of peaks, split roles, and multi-site coverage. One clear schedule and clean time data make long days feel shorter.

The cost of operating without a system

Shift coverage clashes. Tellers are double-booked; the vault lacks a partner for dual control.

Queues extend. Overtime creeps up because nobody sees the pattern early.

Time data arrives late or messy; payroll and finance are left chasing corrections.

Managers rebuild plans manually when a branch closes or a storm hits.

Calls, chats, and spreadsheets overwhelm updates; nobody knows who is where right now.

Teams don’t need grand speeches. They need a plan that updates in minutes and a record that finance can trust—the basic promise of modern bank employee scheduling software.

Bank Employee Scheduling Software methods to reduce no-shows and overtime

At its heart, bank employee scheduling software is a living roster connected to skills, shifts, and sites. It maps who can work as a teller, on the platform, in the vault, call centres, or back-office. It respects breaks, dual control, and labour rules. It manages floaters and cross-trained staff across branches. It allows managers to move people quickly when demand shifts. Most importantly, it makes changes visible to everyone.

Common scenarios:

Payroll day surge. The branch adds a teller window from 11:00 to 14:00, switches a platform banker to cashier for an hour, and staggers lunches. Phones are forwarded to the contact centre during the spike.

Unexpected branch downtime. Power failure at a suburban site. The scheduler reallocates staff to nearby locations, flags safe cash-out, and assigns a mobile CSR to greet customers and manage traffic.

Mandatory AML training. A two-hour session is scheduled for next Thursday. The plan shifts platform coverage to the morning, books the training room, and backfills with a floater over lunch.

Floaters between branches. A loan officer spends mornings at Branch A and afternoons at Branch B. The app pins addresses, logs travel time, and confirms presence with geofencing.

When these changes take one minute—not an hour—service remains smooth and the team trusts the plan. That’s the day-to-day value of bank employee scheduling software.

Selection criteria that actually count

When you shortlist tools, use this field-tested checklist:

Offline mode. Clock-ins and notes must function without signal; data should sync later.

Mobile clock-in/out. Phones or a shared kiosk with PIN/QR; quick supervisor approvals.

Geofencing/GPS. Confirm presence by branch, vault area, or cash centre; reduce “where are you?” calls.

Shift and role templates. Teller, platform, vault dual control, mortgage desk, contact centre, ATM techs.

Roles and permissions. Supervisors, branch managers, and area leaders manage their scope; HR and finance see the network.

Bulk notifications. Push schedule changes for storm closures, payroll spikes, or training windows.

Timesheet export. Clean CSV/XLS for payroll and analysis; one click, no clean-up.

Multi-language UI. Clear screens for mixed teams across regions.

Fast onboarding. Import staff from a spreadsheet; invite by link; publish the first roster today.

Choose the tool that nails these basics. Fancy features won’t help if the plan can’t change fast.

Top-8 platforms for shift-based banking operations

Below is a neutral, practical view of tools banks and other multi-site teams use to plan people and log time. It focuses on coverage, clarity, and speed—not on HR suites or finance systems.

1) Shifton — built for branches, call centres, and back-office waves

Shifton keeps busy days calm. It turns complex coverage into a few clear actions and makes updates visible in seconds.

Why banks choose Shifton

Quick import of employees; group by branch, skill, and clearance; invite by link.

Shift templates for teller windows, platform appointments, vault dual control, mortgage/loan desks, cash room, and contact centre queues.

Mobile clock-in/out plus kiosk mode with PIN/QR; supervisor approvals on the spot.

Geofencing around branches and cash centres; GPS confirms presence.

Offline capture where coverage is weak; data syncs later without loss.

One-tap duplication for recurring rosters; drag-drop to swap people quickly.

Bulk alerts for closures, late openings, or payroll-day boosts.

Consolidated timesheets; clean exports for payroll and audit-friendly logs.

Multi-language screens; clear prompts for mixed teams.

Simple reporting for coverage, overtime, late punches, and branch transfer load.

Shifton’s speed helps banks most on high-pressure days. The same habits work in retail, logistics, and service networks with peaks and multi-site coverage.

2) Deputy

Strong schedule builder and mobile time tracking for many industries.

Location checks on punch; geofence rules depend on setup.

Templates help maintain steady rosters; complex dual-control windows may need extra steps.

Good for branches with predictable patterns or smaller networks.

3) When I Work

Clean weekly rosters and quick onboarding.

Mobile punch with location capture; kiosk option available.

Simple task notes; advanced skill-based rules may require workarounds.

Suits smaller branches and service desks with steady rhythms.

4) Humanity (by TCP)

Mature web scheduler with good visibility across teams.

Useful for 24/7 coverage and approvals; rule depth varies by plan.

Mobile app covers basics; heavy customisation can take time.

Works for banks that want classic web tooling with shift control.

5) Shiftboard

Designed for complex coverage mathematics and rotating teams.

Helpful for cash centres and back-office operations with strict rules.

Powerful engine; configuration can be heavier.

Best when staffing constraints drive the plan.

6) UKG Ready (Kronos)

Broad workforce platform that includes scheduling and time.

Suits enterprises standardising on one vendor across HR.

Robust, but heavier to deploy and manage.

Strong when you already run other UKG modules.

7) Workforce.com

Forecasting and compliance-oriented scheduling.

Clear mobile app; rules and labour models may need tuning.

Good for high-volume service teams; banks adapt patterns for peak days.

Reporting depth is a plus for operations leaders.

8) Quinyx

Workforce optimisation with analytics and forecasting.

Suited to large retail and service networks; banks use it for multi-site planning.

Setup and modelling require effort; strong when data science guides staffing.

Works best with stable data inputs and large teams.

Comparison snapshot in plain words

For offline reliability, Shifton focuses on punches and notes that sync later; some web-first tools assume constant signal at branches. For geofencing, Shifton makes branch-level zones simple; others rely more on basic location on punch. Mobile app experience is strong across Shifton, Deputy, and When I Work; heavier suites often emphasise web dashboards. Templates are quick in Shifton and Humanity; Workforce.com and Shiftboard add forecasting strengths with more setup. Exports are straightforward in Shifton and Deputy; in larger suites you may need to configure reports. Multi-language prompts are clean in Shifton; coverage varies elsewhere by region. Supervisor and area-manager roles map cleanly in Shifton and Shiftboard; lighter tools sometimes need custom permissions. Onboarding is fastest where import + invite-by-link exists—Shifton shines there—and audit-friendly logs help everyone close the week without drama.

Bank Employee Scheduling Software steps for small and multi-site teams

Payroll Fridays. Managers duplicate teller windows for midday peaks, switch a platform banker to cashier for an hour, and send a branch-wide alert. Queues shrink without overtime confusion.

Weather closures. A storm closes two locations. Area leads move staff to open branches in minutes, pin directions in the app, and push no-travel notices to the rest. The plan endures.

Dynamic window mix. Mortgage desk gets busy from 13:00 to 16:00. Shifton reallocates one teller to appointments, safeguards dual-control slots, and resets the mix at four.

Multi-branch networks. Supervisors manage their sites; regional managers see coverage and risk without interfering with local edits. HQ monitors health, not every move.

Fast hiring cycles. New hires join with a link, see their first week, and clock in on day one. Offline capture ensures time stays accurate even in areas with weak signal.

Shifton’s strength is simple: fewer clicks for managers and zero guesswork for staff. That’s the difference great tools make during peaks.

Mini-cases from the field

Regional bank, 30 branches

Need. Overtime increased on payroll weeks; timesheets were closed late.

Setup. Import staff, create templates for teller/platform/vault, enable geofences by branch, and set supervisor approvals.

Result. Coverage gaps were flagged a day earlier; overtime stabilised. Finance exported clean hours every Friday. Managers called the switch a relief powered by bank employee scheduling software done right.

Contact centre with variable call volume

Need. Weather spikes inundated phones; swaps took too long.

Setup. Standby pool with push alerts; kiosk punches at training rooms; real-time queue notes in shifts.

Result. Backfills happened in minutes. Abandoned calls fell. Team leads focused on coaching instead of manual rescheduling.

Multi-city network

Need. Three regions used different spreadsheets; HQ missed a live view.

Setup. Shared templates, region-level permissions, and nightly summaries.

Result. Consistent planning across cities and faster month-end close. Leaders finally compared coverage apples to apples.

Common mistakes (and how to avoid them)

Ignoring offline work. Basements and cash rooms kill signal. Test punches without connectivity.

No geofences. Without branch zones, time is wasted asking where people are.

Heavy onboarding. If setup takes weeks, staff will keep using chat. Demand import-by-file and invite-by-link.

Missing roles. Without supervisor and regional permissions, HQ becomes a bottleneck.

Weak exports and logs. If timesheets need cleaning or lack audit trails, savings disappear.

FAQ

Is offline supported?

Yes in Shifton. People clock in where signal is weak and data syncs later.

How fast is the rollout?

Import staff, pick templates, set branch geofences, and send invites. Many teams publish a live roster the same day.

How do we set roles and permissions?

Give supervisors control within their branches, area managers access across sites, and HR/finance network-wide visibility.

Mobile clock-in/out across branches?

Yes. Staff use phones or a shared kiosk with PIN/QR; location checks can be required by branch.

Can we swap shifts quickly?

Use standby pools and broadcast alerts; the first to accept updates the plan for everyone.

Do we get audit-friendly logs?

Yes. Approvals and edits maintain a trail so payroll and auditors can trace changes without extra worksheets.

Conclusion

Banks, contact centres, and back-office teams deal with peaks, skill rules, and multiple locations. Shifton helps managers publish clear schedules, move people quickly, confirm presence, and export clean time—without heavy projects or additional spreadsheets. The same habits help any shift-based business remain calm during busy days. If your goal is fewer lines, fewer surprises, and cleaner payroll, the right bank employee scheduling software pays for itself in saved hours and smoother shifts.

Create your Shifton account and schedule your first branch team today.

English (US)

English (US)  English (GB)

English (GB)  English (CA)

English (CA)  English (AU)

English (AU)  English (NZ)

English (NZ)  English (ZA)

English (ZA)  Español (ES)

Español (ES)  Español (MX)

Español (MX)  Español (AR)

Español (AR)  Português (BR)

Português (BR)  Português (PT)

Português (PT)  Deutsch (DE)

Deutsch (DE)  Deutsch (AT)

Deutsch (AT)  Français (FR)

Français (FR)  Français (BE)

Français (BE)  Français (CA)

Français (CA)  Italiano

Italiano  日本語

日本語  中文

中文  हिन्दी

हिन्दी  עברית

עברית  العربية

العربية  한국어

한국어  Nederlands

Nederlands  Polski

Polski  Türkçe

Türkçe  Українська

Українська  Русский

Русский  Magyar

Magyar  Română

Română  Čeština

Čeština  Български

Български  Ελληνικά

Ελληνικά  Svenska

Svenska  Dansk

Dansk  Norsk

Norsk  Suomi

Suomi  Bahasa

Bahasa  Tiếng Việt

Tiếng Việt  Tagalog

Tagalog  ไทย

ไทย  Latviešu

Latviešu  Lietuvių

Lietuvių  Eesti

Eesti  Slovenčina

Slovenčina  Slovenščina

Slovenščina  Hrvatski

Hrvatski  Македонски

Македонски  Қазақ

Қазақ  Azərbaycan

Azərbaycan  বাংলা

বাংলা